Renovations That Offer the Best ROI for A Multifamily Property

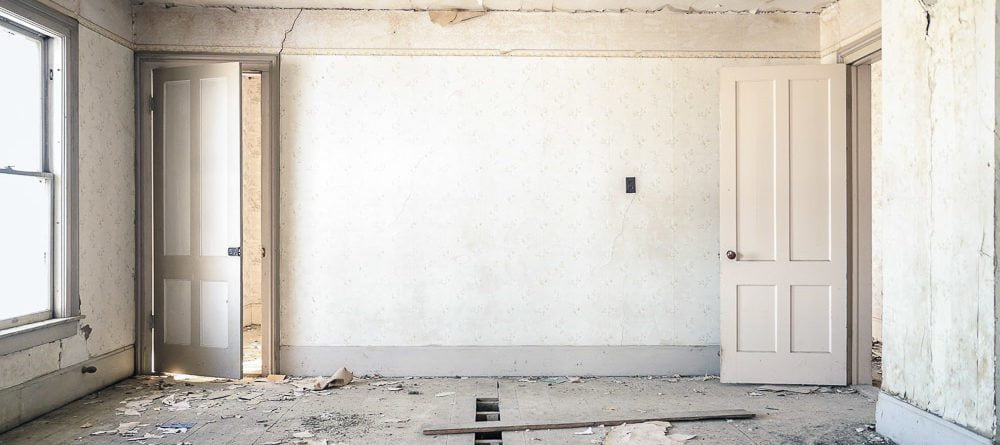

There is a tried and tested philosophy in residential real estate that goes something like this: target the worst home in the nicest neighborhood and add value through renovations.

For multifamily real estate investors, logic then begs this question: “Does this same approach apply to multifamily housing?” The answer—not too surprisingly—depends.

If you’re looking for a strong, immediate ROI on a real estate investment, you may do well to look for an older property in a desirable area that may simply need an upgrade or an uncomplicated repair. Through a quick, multifamily property flip on a property like this, you can easily find yourself commanding top dollar for your rental units.

Don’t be surprised if logic taps you on the shoulder again with a follow-up question. “So, what type of property rehab effort will give me the most bang for my buck?” There is no perfect answer because there isn’t a magical list of comprehensive repairs and renovations, their costs, and their value as an incentive to rent. The reality is that there are many factors involved in determining a realistic rent amount, and they can include:

- The location of the property

- The property’s age, condition, and current amenities

- The profile of the tenants in the area

- The rental values of comparable, competing units

Potential Projects Proven to Generate Returns

There are a handful of rehab efforts that investors generally recognize as safe bets because they are highly likely to result in a significant rental increase. The most common are:

- Exteriors: Upgrading landscaping, signage, and outside common areas can significantly reinvigorate a property’s curb appeal—a major influence on a potential tenant’s decision to rent from you. A great, first impression is critical.

- Flooring: Replacing standard carpet with tile, vinyl, or wood flooring offers two advantages: it gives a space a more modern, clean look, and it’s easier and less expensive to maintain—something that tenants recognize and assign a lot of value.

- Amenities: Adding a washer and dryer (or hookups) to a unit increases value and convenience because it eliminates a tenant’s need to leave in order to do laundry. Much like non-carpet flooring, tenants highly value amenities that make their lives easier.

When establishing a benchmark for a reasonable return on your rehab investment, it’s important to set realistic expectations. Most experts agree that a ten to thirty percent bump in rent is achievable after a rehab effort is complete.

Multifamily property rehabs are potentially lucrative opportunities, and should be part of your investment program. And yes, it takes a special kind of patience to get through a renovation—but it’s worth it.

One key factor in the success of such a venture is having access to funds to facilitate needed upgrades to the property. Specialized services such as Value Add and Sub Rehab loans can help you fund rehab projects you’re considering.