Is There Arbitrage Opportunity in Multifamily Today?

Arbitrage is such a great word. It implies some sort of mystery, intrigue, intelligence, and opportunity. All things that are attractive to us as humans and certainly the opportunity piece as multifamily investors.

The word emerged through the course of a conversation I had with a friend and real estate broker this week as we discussed market conditions and interest rates. There is a subtle arbitrage opportunity in today’s multifamily marketplace given where interest rates have fallen to and cap rates have lagged in following suit.

More on that in a second.

I started the year with the goal and grand ambition to write, post and share an article every week. My hope was to continue to connect with you, provide value to help you be a more successful real estate investor.

The last couple months have been busy with low interest rates and added complexities to loan underwriting due to the pandemic. I haven’t been making the time to send anything out. But I’m trying to get back on track.

We all have our excuses as to why some of our goals and ambitions slip away from us. But this whole pandemic thing is new for all of us. And it is perfectly right for us to be kind to ourselves during this time.

A lender I work with shared an article with me worth sharing with you. It’s a 13-minute read so a bit longer than most, however it specifically addresses some of the funk high achievers have felt during the COVID-19 pandemic.

As commercial real estate investors we are high achievers. There aren’t a lot of people that have the discipline, courage, and commitment to be in the multifamily ownership game, so in my book, we’re all high achievers just by being in this space.

We are facing an ever-changing situation with all sorts of competing information and the only thing we can really count on at this point is “indefinite uncertainty”.

My point isn’t to paint a bleak picture, but to acknowledge these are very challenging times, and if nothing else, I’m trying to give myself and everyone else permission to cut ourselves some slack.

Here’s the link to the article

So… With that said, back to some quick thoughts about arbitrage in today’s market.

Two years ago, interest rates were on the rise, and they had been for most of 2018. I recall some loan quotes touch the 5% mark. It sounds ridiculous right now. But the appetite for multifamily assets was strong and deals were getting done.

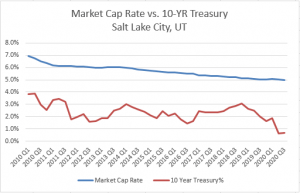

Q3 2018 the cap rate for the Downtown Salt Lake City metro area was 5.23% according to CoStar. Today we are at 4.99%. I’ve seen some reports saying we’re closer to 4.7-4.8% currently. Either way, there is a much larger delta today between cap rates and interest rates than there was 2 years ago.

I compared quarterly data from the last 10 years from the Salt Lake City market in the two charts below. The spread between cap rates and interest rates is at decade highs. When we hit extremes, that usually means there is opportunity.

With interest rates in the low 2’s with HUD; high 2’s on large Agency deals and 3-4% on smaller Agency deals and Bank Loans – now is a great time to recapitalize and/or lock in a low rate on a new acquisition.

There are a million variables in this multifamily game, and one of the biggest contributors to your cash flow and portfolio growth is the debt structure you have in place on your assets.

Right now just may be the time to improve your position, I’d love to chat with you about it.